June 29th 2023 2:20pm UTC+0

Introduction:

The crypto market has been its usual rollercoaster ride lately, leaving many investors pondering when this enduring bear market will come to an end. However, within the ebb and flow of volatility, there are crucial insights to be gleaned. In this article, we’ll delve into the current state of the crypto market, shedding light on key observations that will help you navigate through these challenging times.

The Uncertainty of Market Timing:

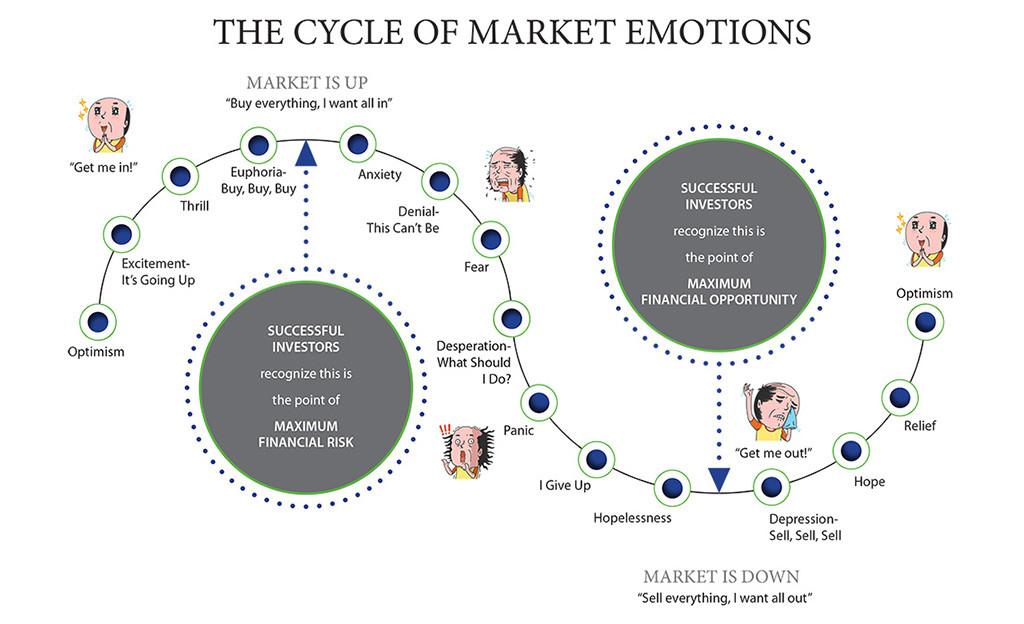

Financial markets possess a knack for surprises, often defying mainstream narratives. Just when you’re convinced that the market has hit rock bottom, it drops even further. Conversely, when hope seems all but lost, the market subtly begins to turn. So, what does the bottom of a market look like? Are we on the cusp of reaching it, or have we already passed it?

Holding On in the Bear Market:

As someone exclusively involved in the crypto market since 2015, I understand the need to have some skin in the game. I hold onto certain tokens to ensure I’m not caught on the sidelines when markets unexpectedly surge. This strategy, known as “HODLing,” often results in heavy losses during brutal bear markets. However, by supporting a diverse range of projects I genuinely believe in, the hope and potential associated with these ventures alleviate the pain experienced during a bear market.

The Relative Perspective of Drawdowns:

In the realm of cryptocurrencies, a 70% drawdown may be considered significant, but it pales in comparison to an 85% drop, which signifies an additional 50% decrease. Likewise, a 92.5% plunge indicates another 50% haircut, and a 96% decrease feels akin to losing 50% of your investment all over again.

Consider for example a token called ‘Juno’, this Cosmos token once reached an all-time high of $45.74, but now sits at a mere $0.26, down 99.43%.

Did it break?, did it ‘rugpull’ (project abandoned or funds stolen) perhaps ? did the developers leave? well.. no !. Yet down and down it has gone. Once the posterchild of a bright narrative “the home of smart contracts on Cosmos” and now brutally smashed at the hands of the bear market.

This exemplifies the maximum pain that investors can face. In hindsight, swapping the likes of Juno for the ‘established ‘safe havens’ of BTC or ETH when the market started to turn would have been an optimal move for a crypto ‘hodler’, even though fiat currency would have been the ultimate win.

The point I am labouring here, the difference between 70% to 99% is a huge leap in pain for an investor.

Consolidation and Capitulation:

In recent months, it appears that numerous tokens are undergoing a process of consolidation and capitulation, with investors shifting their focus back to BTC and ETH.

These tokens may become the “what if I had bought them at the bottom” assets once the market reverses course.

Even before the collapse of Luna, the market faced incredible headwinds, and subsequent events, such as the Celsius, Grayscale, and USDC “depeg,” as well as regulatory challenges in the US, further intensified uncertainty and poured cold water on the crypto industry.

A Fundamental Shift:

However, recent months have brought about a notable shift, albeit not entirely positive. The US Securities and Exchange Commission (SEC) unleashed a blitz targeting exchanges and coins deemed securities, portraying the entire crypto space as a haven for fraudulent activities.

Many industry commentators noted similarities between what has been happening to crypto companies in the US with ‘Operation choke point’, which was the ‘war’ waged by US DoJ on money laundering. At the time (2013), authorities shut down banking facilities for international online gambling, pawnbrokers and payday lenders in a co-ordinated attack.

This ‘Operation Chokepoint 2.0’, with US regulators and state machinery specifically targeting a crippling attack on the established crypto players is an idea that has been well discussed, for instance here;

https://www.cooperkirk.com/wp-content/uploads/2023/03/Operation-Choke-Point-2.0.pdf

At times it has seemed like this could be the end of the road for the industry in the US at least. Yet, emerging from the depths of despair, previously unknown companies have begun developing regulatory-compliant exchange platforms, filling the void left by the SEC’s actions.

Interestingly, the coins they feel comfortable listing are $BTC, $LTC, $BCH, and to some extent, $ETH. This development raises questions about whether this represents the long-awaited clarity sought by the market or if there was a broader plan in play from the beginning.

It appears that the recognition of crypto as an asset class that refuses to fade away has finally taken hold. The USA is now embarking on a new era of crypto 2.0, regulator edition.

Bullish Signals Amidst Challenges:

So, is this shift bullish for the crypto market? It certainly seems that way. It implies that not only will the US remain a significant player in the crypto space, but it also signifies a race to determine the cultural homeland of crypto moving forward.

As long as the US maintains its involvement in the crypto industry, the rest of the world can make plans with the assurance that the global market won’t lack US participation. However, it’s crucial to acknowledge that crypto market prices may not have reached their rock bottom yet, especially considering the prevailing interest rate and inflation environment that presents an ongoing risk of recession.

Nevertheless, with the recent turn of events, it feels like the tide has shifted, and once global macro conditions improve, the crypto market appears primed for a substantial rally.

Prominent Bullish recent Crypto News Headlines:

The past few weeks have witnessed an array of news headlines that, under different circumstances, would have sent prices soaring during a bull run:

- MicroStrategy, a leading business intelligence firm, has acquired an additional 12,333 BTC, bringing their total holdings to 152,333 BTC.

- Despite the SEC lawsuit against Coinbase, the exchange’s shares have surged by 35%.

- Ledger, renowned for its hardware wallets, has ventured into the institutional trading space with the launch of Tradelink.

- FTX, a prominent cryptocurrency exchange, has initiated the process of relaunching its platform.

- Hester Peirce, a commissioner at the SEC, expresses the opinion that US crypto laws should not assume that “everything is a financial asset.”

- The US welcomes its first leveraged Bitcoin exchange-traded fund (ETF), which generated $5.5 million in trading volume on its first day.

- The European Union shows signs of progress toward the digital euro, with ECB President Christine Lagarde stating that developments could occur as early as October.

- JPMorgan introduces its JPM Coin, which aims to facilitate stablecoin transfers.

- Soros Fund Management, led by renowned investor George Soros, states that crypto is here to stay.

- The Carbon Opportunities Fund and Sumitomo Corporation of Americas collaborate on the first tokenized carbon assets transaction within the Climate Action Data Trust.

But perhaps the most significant headlines highlight the following significant developments:

- BlackRock files for Bitcoin exposure.

https://www.ft.com/content/1886c3a3-3fb8-411a-b95a-e4667de560d1 - NASDAQ and Deutsche Bank express interest in crypto custody services.

https://coinmarketcap.com/community/articles/6491c26f6275ab10c1bb4d95/ - EDX Markets launches, backed by Citadel, Fidelity, and Charles Schwab, introducing a new crypto exchange.

https://techcrunch.com/2023/06/22/fidelity-schwab-citadel-backing-new-crypto-exchange-edx-signals-tradfis-deeper-dive-into-digital-assets/

Conclusion:

In light of these developments, determining the best strategy to navigate this market depends on your unique circumstances. If you’re a crypto ‘Hodler’ (those who ‘Hold On for Dear Life’ through bear markets), then exercising patience a little longer and considering diversifying your portfolio with SEC-favoured assets like BTC, LTC, BCH, and possibly ETH may be a prudent move.

For new entrants, identifying resilient coins that have weathered the storm while continuing to build, with a focus on narratives like SEC winners, staking products and providers, AI and VR projects, and perpetuals, can offer promising opportunities.

The excellent @metaquant account on twitter explains the musical chairs of crypto narratives well as seen below:

Final Thoughts:

While we may not definitively claim this as the “bottom of the bear,” in relative terms, compared to global stock market indices, this past few weeks appear to be a significant turning point.

Non-crypto people always seem to ask me if its a good time to buy right at the top of the market, I would love to convince them more at the pit of the bear, but they usually are not interested, it just seems that is the way of the world.

This is the time where people will likely look back and say ‘ if I had only bought ‘x’ at such and such price. There are surely many crypto assets trading at deep discount to future value.

Not financial advice, of course, but if you were a person who had already decided they would buy crypto ‘at some point’, I can think of worse times to do that.