“Cosmos is coming to Kill your Fat protocol Thesis”

– Zaki Manian

If you have time I encourage you to watch this mind-expanding episode, link here:

https://www.youtube.com/watch?v=pO5OO5vOlys

If you don’t have time right now, I offer a summary below.

Guests

Sunny Aggarwal (SA)

Zaki Manian (ZM)

Hosts

Ryan Sean Adams (RSA)

David Hoffman (DH)

Introduction

Zaki @zmanian & Sunny @sunnya97 are crypto OGs, currently leading thinkers and builders operating in the Cosmos Ecosystem.

Zaki recently helped ship IBC and runs validator operations, he is an advisor to Electric Coin Company electriccoin.co @ElectricCoinCo, Co-founder at @iqlusioninc @sommfinance.

Sunny runs Osmosis @osmosiszone, a DEX on Cosmos and co-hosts Epicenter podcast@epicenterbtc

Opening topic

CosmoVerse Conference (Medillin, Columbia, Oct 2022)

(ZM) This was community driven event that ran last week in Medellin, Colombia. It was put together by community activist @Cryptocito. There were >1500 attendees, yet last year it was 500 despite being far more accessible (Lisbon) and with no overflow from other conference tourists. Did not feel like a bear market event at all.

Key question: Why did DyDX ($DYDX) decide to move from Ethereum $ETH (StarkWare) to its own appchain on Cosmos?

Well, the reasons for moving to Cosmos are more complex than a single simple metric like speed (TPS) or Security.

The reasons need deeper investigation. This latest move by DyDx has snowballed and now more people investigating the Cosmos ecosystem.

Also Terra Lunas’ collapse brought attention and soul searching. After all, Terra Luna ($LUNA /$LUNC) is/was IBC enabled, the Anchor protocol ‘carry trades’ passed through Osmosis Dex ($OSMO) on cosmos. So the collapse felt like a devastating blow to ecosystem and it was unclear how long it might take Cosmos to recover.

Cosmos’s Central Thesis

(RSA) It has been said that Cosmos is an idea rather than a thing, what does this mean?

(SA) Central Thesis of Cosmos – There will be a world of many blockchains, mainly app-specific (Appchains). As far as security and settlement are concerned, in Cosmos…“There is no single final settlement layer” ..rather there will be many many settlement layers.

Every Appchain is going to operate as its own settlement layer, for its own native asset, delivering fundamental sovereignty to that application. Whereas the rollup approach (on Ethereum, Layer 2’s) are not sovereign from the main chain, in their case the main chain is the final arbiter of truth.

Cosmos is ‘localist’ .. It is not a world computer but rather a community of computers that all talk to each other.

(ZM) “Cosmos is coming to Kill your FAT protocol Thesis“

The so-called “Fat Protocol Thesis” is that value accrual in blockchain systems comes through the infrastructure layer, represented usually by a Base Token, plus apps that sit on top of it. The infrastructure layer plus the network effects are controlled by that base token, so that’s naturally where value will accrue.

The Cosmos Thesis flips this and says that value should /will accrue from the App Layer. Applications are closest to the users, this is where the intent and order flow originates, then this is where the value will accrue.

So, Cosmos represents a blockchain stack that is built in such a way that the best possible applications can easily thrive there.

In the 90s, people believed the best bet on the internet was to buy AOL / CompuServe (Infra providers) but it turned out it was Google/Amazon at the application layer that had the user relationships (n.b. they later became a key infra layer as well, creating AWS and Google Cloud).

Application developers can reasonably easily move between base protocols infrastructure layers but the users themselves are stuck/sticky to the app so that is where revenue can be found and where there exist sustainable market forces.

(RSA) So is this kind of the ‘Fat App’ thesis ?

(SA) I prefer the term ‘Tall App’ thesis. Representing a desire for ‘Vertical integration’, e.g. we build front end/dex/appChain and the primary wallet, all designed to give the best user experience (this is modelled on Apple approach).

Metaphors & Ethereum vs. Cosmos

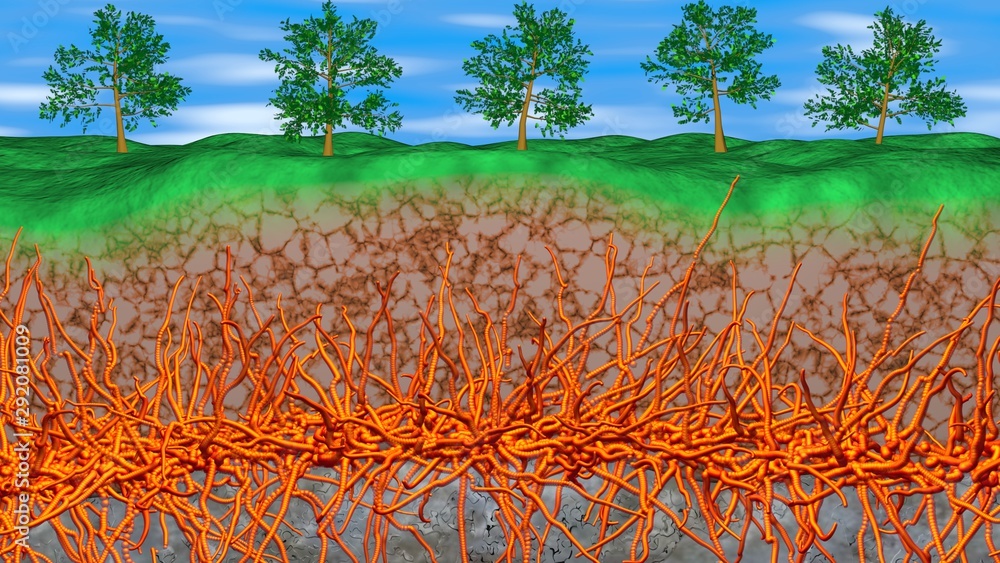

(DH) Ethereum model can be represented somewhat like a tree. With a primary Layer 1 like the trunk of a tree, then Layer 2’s are the main boughs, Layer 3’s as branches and leaves. So, is Cosmos represented more like a mesh network ?

(ZM) Cosmos is represented more like a ‘mycelial network‘, i.e. like a fungus , pervades forest and earth, makes it so trees can talk, automatically resilient as no central focal point.

A core difference of opinion between ZM/SA and Vitalik @VitalikButerin is that he seems to believe that monetary premiums are really hard to build, and therefore its most important to build secure decentralised censorship resistant systems. In Ethereum this is the root beacon chain and everything descends and is reinforced by this chain.

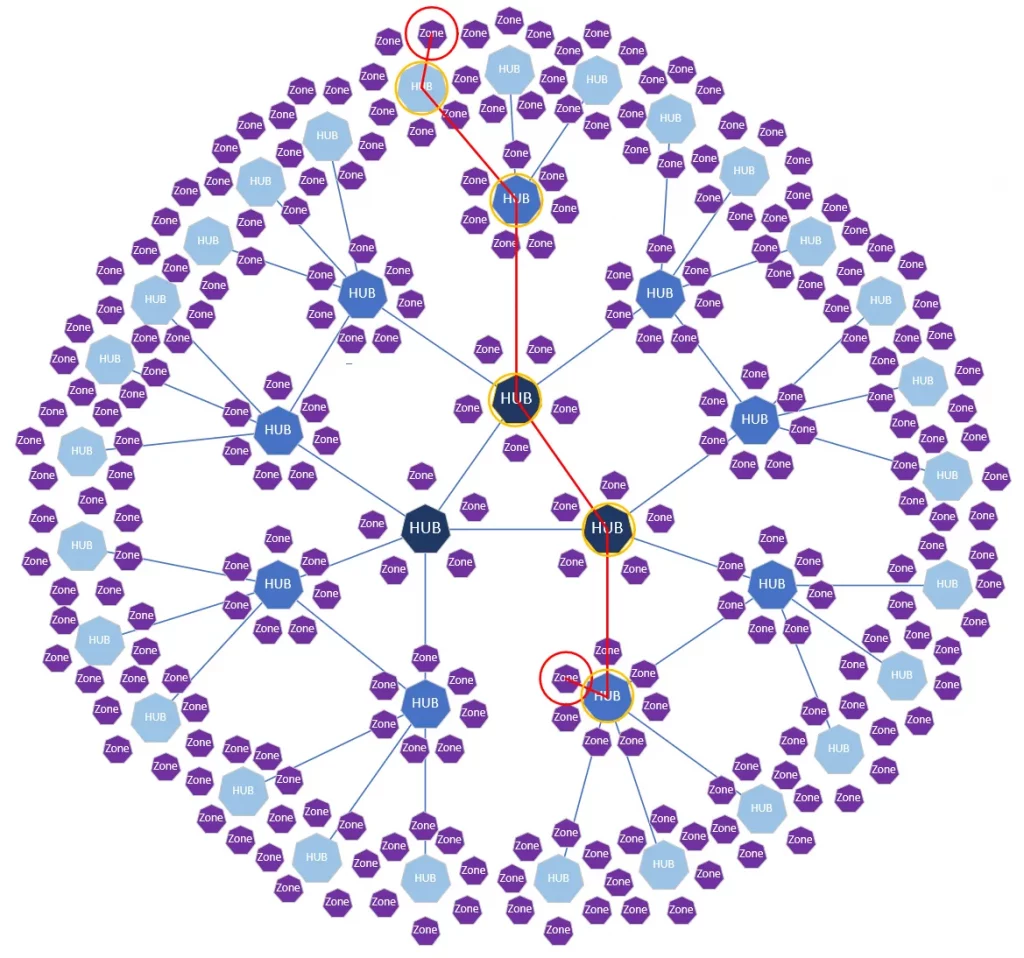

In Cosmos, we believe in naturally forming ad-hoc economic networks, for example USD carry trades. These natural economic trade routes exist, for example between Atom>>Osmosis>>OkEx>>Crypto.com. These protocols and platforms share user bases and connect themselves closely with yet further Cosmos IBC chains. There is a network of value which will form between a community of computers.

Security must travel with economic independence and therefore we do not need the root structure.

(SA) In Cosmos, chains should and can provide bi-lateral security with each other.

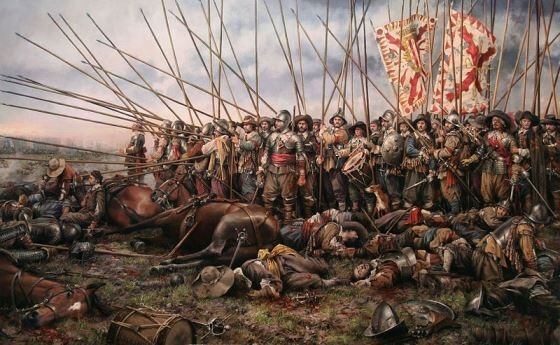

By way of a geopolitical analogy, NATO members do not meddle in political affairs but do share security.

The same principle applies to Cosmos chains, e.g. Osmosis and Axelar networks.

– Osmosis makes up 70% of Axelar’s Total Value Locked(TVL)

– Axelar provides nearly all stable coins to Osmosis DEX liquidity pools.

So they are interdependent, they should both provide shared security to one another. $OSMO stakers should provide economic stake to secure Axelar and vice versa, a symbiosis. Both combined market caps then provide the security.

(RSA) But there must be Trade-offs, if you are sacrificing monetary premium? Cosmos is suggesting the base currency should not accrue monetary premium, whereas in Bitcoin ($BTC) this IS the use case and in Ethereum the Monetary premium gives free security to its applications.

So Why not have monetary premium?, and how can other Layer 1’s compete against the free security of bitcoin and Ethereum?

(SA) Mesh security represents a non-rent extractive way of getting free economic security for your chain .

When building on a monetary premium focussed Layer 1, you will always have gas fees and extractive Miner Extractable Value (MEV) costs to pay, whereas AppChains form economic alliances to provide non-extractive security.

(SA) Many years ago he wanted to make an ‘AppChain layer for Bitcoin’, as he could see that a monolithic model didn’t make sense. Bitcoin IS essentially an AppChain, its a very simple model, its only purpose is to control issuance and movement of Bitcoin. So using Bitcoin as an AppChain on Cosmos could underpin monetary value in Cosmos.

However his view has since shifted.

There is a project called Babylon (https://babylonchain.io/) that is using Bitcoin’s monetary premium to create a system that can provide economic security to Appchains.

The idea of Babylon is to provide checkpoint Proof of Stake block headers into Bitcoin’s Proof of Work System, thus sharing the benefits of fast finality and economic security. This could be the best of both worlds. Babylon is bringing back the idea of monetary premium economic security to Mesh networks. This is an opt-in model for Cosmos chains.

(RSA) But doesn’t this lose the native security of Bitcoin? Native Bitcoin secured by miners, doesn’t this shift to less secure AppChain validators.

(SA) Secure bridges into Bitcoin is important, and many are working on this. The ‘Drivechains’ model is being looked into but he has learned you should not push hard on Bitcoin core developers, he believes these security assurances will exist in 5-10 years.

(ZM) Too many teams that build layer 1’s lack background in the crypto space and are new. As a long term builder, he started cosmos (research) in 2014 in the spirit of building sustainable systems. He doesn’t want to build things that, if they ‘lost the meme’ then they collapse(hey .. $LUNA/LUNC). Losing the ‘meme’ of Bitcoin or Ethereum as a premium monetary asset would kill rollups.

(ZM) “Start by building a system that is secure in the absence of a monetary premium“

If you get a Monetary premium then great but don’t build based purely on this.

(RSA) Does the roadmap for Atom 2.0 aim to increase monetary premium for $Atom?

(ZM) Yes this is part of it’s design, to increase the probability that value will accrue to Atom.

But, look at Gold, if this is monetary premium asset of the fiat system, with its total value at $1 Trillion and yet the Top 10 companies (Apps) are >$1 Trillion.

So why can’t the top 10 AppChains have more monetary premium than the base layer asset?

Total economic security can come from a productive asset.

(DH) What is stopping one chain from becoming way more useful and central than the others and might this get more monetary premium network effects and central control by default?

So, it starts off as being a mycelial network with horizontal structure but with time the ecosystem ends up with an asset positioned in the centre of everything? E.g. Osmosis (also please explain Osmosis).

(SA) Osmosis is currently an automated market maker (AMM) Decentralised exchange (DEX) currently we are adding other functions with the goal to be the global number one Exchange. We didn’t want to be limited by the limitations of the platform we were built on . We have lots of ideas about improving the UX and adding new functions such as privacy.

At first we thought about building Osmosis as an EVM compatible chain, but the ideas we had would not work, the complexity and nuance was too much for EVM. So we decided to create our own chain, with better control over the cryptography / codebase and wallets. This is full stack control.

Inter-Blockchain Communication protocol (IBC) enabled Osmosis to become Cosmos’s first ‘killer app’ and it has become a centre of user activity and liquidity (As also was Terra Luna).

Highly organic systems can form natural connections. Sunny believes in ‘Hayekian’ power laws, not a hub and spoke system.

Mesh Security – So why did he not want it all to flow through Osmosis? Well, the goal of Cosmos was point-to-point routing, where all chains are the hub for their own native assets.

They have spent 3 years building the app. So far, the $OSMO token has been a key trading pair but going forward the UX will demand more and more Stable-coin pairs. Osmosis is also now the second biggest DEX for PolkaDot $DOT and has huge pools of $WETH and $WBTC.

USDC on Cosmos

(ZM) Key thing about Cosmos is that most of the core developers are also working on DApps. Ethereum has a gulf between these two types of developer teams.

On most other Layer 1 chains, e.g. $DOT/$AVAX, you have the issuing chain and all the applications settle on top of that underlying chain. But in Cosmos, the issuing chain for $USDC might be $ATOM and yet the USDC asset then moves and becomes used for say @DyDX or @Agoric or @SeiNetwork or Osmosis. This is the true multichain, this gives native USDC without cross chain bridging to any launching chain (for free). Exciting to see USDC move on to multichain thesis as to date it has been focussed on monolithic Layer 1s.

Zaki thinks the USDC/Circle announcement was underplayed in terms of how much of a big deal it is for Cosmos. The implementation means USDC is available to any builder for free.

(RSA) likes this much better than using Bitcoin as a monetary asset on Atom/Cosmos as you are not sacrificing anything in terms of sovereignty.

There are two main visions: “Layer 2” vision versus “the Cosmos Multichain” vision

(RSA) Ethereum multichain vision – All chains settle and use Eth security, it seems both projects have broad agreement that AppChains are the way forward, but in Ethereum ZkSync and others are providing the scalable EVM layers as a Layer 3 (using rollup tech).

Benefit of this approach, Ethereum level security, no requirement to pay for the ‘Military’ (Security) plus it preserves much of the sovereignty, is tapped in to network effects and benefits of access to the Ethereum community plus advanced cross chain bridging in place.

How does this contrast with Cosmos Multichain vision?

(SA) We have a name for the Ethereum approach as described above …‘Empires and colonies’…

In Cosmos we are building for self-sovereign systems.

(ZM) we have been pushing the AppChain approach for a long time, dialogue has been going since the inception of Ethereum. Has discussed this at length with @vitalikButerin, there is affection and friendliness to their relationship, considered the communities now to be more like brothers.

Zaki did not like the early Ethereum roadmaps such as off ramp into sharding and the state channel plasma approaches to scaling. He was delighted when Ethereum community started talking about the importance of “Single Slot finality” and “Appchains ” as the way forward.

(ZM) Firstly, he thinks they can and will co-exist.

Technical reasons for Cosmos AppChain approach.

A blockchain is comprised of 3 things;

1) An execution environment

2) Data Availability layer

3) System of bridges

Ethereum is trying to build one of each of these;

1) A canonical place to post zk and/or fraud Proofs (for scaling mainly)

2) One bridge to all other networks

3) One Data availability layer (provisioned now by ‘DankSharding’)

Once you are using these then a project can investigate all the executions environments it wants, but usually at a cost.

The Cosmos Vision is:

1) Bridge wherever you want we have IBC

2) Post zk / fraud proofs anywhere you want. For example we have Celestia @CelestiaOrg which functions like an data availability AppChain enabling a rollup type ecosystem

3) Use our free toolkit for building your own custom execution environment

So this is a key difference, the execution environment templates are not free in Ethereum, and this is part of the reason why DyDX moved across to Cosmos.

In Cosmos, Tendermint, the core consensus layer and Cosmos SDK stack of Cosmos is fully open source, with Apache 2.0 license, its creation was funded by Atom development team. These funds were built to create a public good for everyone.

(SA) Robert Leshner @rleshner of Compound @compoundfinance spent a year trying to build out Compound on Substrate($DOT) but they gave up, Sunny believes they should have used Cosmos . You can build really fast, much faster than using rollups also.

There are two frameworks in rollups:

1) EVM compatible – but this is not good for some use cases.

2) Building Optimistic or ZK Rollups it is really hard to build Rollups for custom state machines

CAIRO is a very good cutting edge tool for building EVM execution environments.

But its hard, you need to master a programming language that’s like a ‘prototype ‘C’. Versus having the ability to use more accessible languages GO and Rust in Cosmos.

Cosmos Ecosystem is focussing on a higher level of the stack than Ethereum. For example, the state machine, the CosmWasm VM (best desined VM in Crypto because of how it does cross chain composability).

For example, DAOs on one chain can do transactions on another chain. This comes from having core devs who are also app developers.

Fraud and validity profs will come but first comes a better UX and app features.

(RSA) Cosmos is building “App-Down”, Ethereum building “Protocol UP”

What about DOT vs Cosmos, Has Cosmos ‘won’ ?

(ZM) firstly, we have friends at Parity and respect them. IBC to Polkadot is also a work in progress. The zk-IBC may only be one year away. We are bridging to DOT.

Market Cap Wise DOT is winning. But, as an example using the news about USDC launching on Cosmos.

Does DOT have an app that will mint $1billion on day one? Cosmos has dyDX, and the ‘floor mint’ when moving DyDx’s user base is 1bn USDC, so. 1Bn USDC needs to be ported when the StarkWare environment shifts to cosmos.

Cosmos doesn’t believe in charging ‘rent’ to its app developers, we aim to create collaborative environments that bring the best apps and these apps bring scale.

(RSA) Did PolkaDot try to ‘ split the difference between cosmos and Ethereum approaches, taking the middle road of monetary premium asset with app chains thesis? But perhaps the ‘middle doesn’t hold’…

So if Ethereum is an ‘empire’ (though not evil, no one would say VB is evil) then, yes, there is a rent extraction model. But this is not as adversarial as Polkadot $DOT due to its enormous network effects.

Cosmos has City States model whereas $DOT gives sovereignty to chains but is fundamentally rent extractive and so far this model is not picking up demand.

(DH) Nature has made the crab 10-20 times (i.e. this solution / form of a Crab in nature has emerged as a species independent of each other many many times). Natures build of the Crab is a ‘good strategy’.

Same for Ethereum (monetary asset) and Cosmos (Tall app/appchain) models in blockchain space. These are solid strategies for blockchains that scale, perhaps there is also Bitcoin model, but this can also be viewed essentially an AppChain (providing a Store of Value).

MEV Problems & Solutions

(SA) Lets talk about Miner Extractable Value (MEV). On Uniswap, of the fee revenue for transactions, currently around 1/3rd goes to liquidity providers, 1/3rd for gas payment and 1/3rd to MEV. On Ethereum these are the rent extraction costs and in the case of Uniswap it represents a leaking of value away from its users.

Cosmos on Appchains approach is that transaction revenue as gas fees should never be the meaningful source of revenue. Sunny is critical of EIP 1559 on Ethereum for this reason.

Why not use gas fees as revenue model? because Blockspace on BFT blockchain systems will be cheap in the long run so chains should not compete on this metric. It’s a race to zero and shrinking / unsustainable revenue.

Games and NFT have moved off of Ethereum already due to fees.

At Osmosis, we want to;

- Mitigate ‘Bad’ MEV

- Internalise ‘good’ MEV

What is Bad MEV?

Bad MEV comes from actions based on others transactions e.g. ‘Sandwiching’, font running, copy trading – these represent a fundamental privacy breach ** It is a bug that the mempool isn’t encrypted **

We are building a threshold decryption so that mempools can be encrypted.

What is Good MEV ?

Not ‘extractive’ e.g.

– Arbitrage where prices on a DEX can be improved by using Centralised exchange liquidity.

– Arbitraging prices within DEX pools themselves, i.e. internal circular routes, making better use of liquidity. Mass triggering liquidations.

You want these things, we need internal pools to be arbitraged and fast liquidations. There is a value in being allowed as the first person/entity in a block to execute these things.

So we have been working with a team called SKIP to develop approaches. Instead of utilising ‘off-chain cartels’ of validators, e.g. FlashBots, teams that are not part of the core protocol and become too ‘profit maximising’

AppChains benefit from the infrastructure developers understanding the nuance and semantics of applications built on top of it. They can be opinionated about ordering transactions, promoting social good.

For example:

– All trades should happen in a block before any major liquidity removal in that block, in order to avoid liquidity rugs

– Detecting ‘sandwich attacks’ – invalidate sandwich transaction ordering

This gives Cosmos a revenue opportunity. We can implement ‘Top of the block’ auctions in the protocol itself.

This would mean a bidder pays for the right to have the first transaction in a series of contiguous blocks. This promotes good MEV and returns value to the security providers, e.g. Osmosis Stakers.

The AppChain model allows you to choose payment to the relevant community pool, and provide kickbacks to users.

ATOM Cosmos 2.0

(RSA) Lets move on to talk about Atom 2.0. Previously the revenue model for $ATOM, at least from an investor point of view, was bad, what is changing?

(ZM) Atom 1.0 was a prototype Proof of Stake Chain. There was no live Proof of Stake (PoS) chain that had at the time taken that economic model into reality.

The AppChain thesis is central to cosmos, but then we asked …

‘what the hell is the appchain of the Cosmos Hub ?’

..So SA/ZM and Ethan Buchman discussed approaches to make Atom more of an Application itself. This starts with implementing protocol token Issuance that helps bring $Atom closer to that of being a monetary asset away from further issuance.

(RSA) This sounds like a Monetary policy change, did Atom capitulate and absorb the ETH ultrasound money meme ? previously there was a variable issuance of Atom between 7-20%

(ZM) yes we targeted a 67 % staking rate, to prevent attacks on the network, allowing for central exchanges floats and LP pools. Now we are in the first phase going for a high issuance that then tapers off to 1%

Liquid staking is being designed to be easier on Cosmos than on Ethereum (where they have made it hard-to-do on purpose, but it emerged anyway) so we create competition for providing this service, with no super dominant provider such as LIDO, mitigating centralisation concerns.

Cosmos is fundamentally taking a very different approach to liquid staking. We think liquid staking and derivatives are important to the security budget of the system, it allows users to stack up yield away from staking.

** Instead of compensating with Yield we are giving users free access to Defi to maintain yield yet remain staking and keeping that economic security. So we can reduce issuance accordingly **

At least six liquid staking protocols are in process of launching and we are working very hard on core cosmos layer at improving the UX of liquid staking generally at a protocol level.

Yield will be falling on a yearly basis. Issuance goes up at first, funding the community treasury. There was only $10m in our Cosmos community pool whereas competitors have huge reserves. Lots of stuff needs to be done so lots of funds required for development. After this first 3 year period the issuance drops to around 1% ongoing.

(RSA) So Liquid staking becomes a first-class citizen. But what is the app of the Cosmos hub? is it Interchain security?

(ZM) First there are two terms 1/ Mesh security, 2/ interchain security.

Technically similar but interchain security is promoting the use of cosmos core validators ‘for hire’ by consumer chains.

We found enormous demand from consumer chains for interchain security, where we had not expected it from;

1) High Value single purpose chains such as $USDC, who want to launch quickly, want access to Cosmos community but do not want to think about tokenomics. This would help accrue value to Cosmos.

2) Building security sensitive things like liquid staking providers. If they get attacked then there is a risk of “cascading” effect needs to be mitigated **

3) Projects targeting piggy-backing the network effect around Atom, cross-pollinating communities

(SA) regarding the Mesh security vision. I taught a course at Berkeley, it was politics and history of Switzerland and how did it become so rich and successful?

1) It was credibly neutral

2) Had the best military in the world – These were essentially mercenaries for hire.

This is a metaphor; Cosmos hub Validators can become credibly neutral mercenaries for other chains.

(ZM) WE have set things up so that you can seamlessly join / leave hub shared security environment.

Market Forces will prevail in Cosmos, it represents a pluralist environment, rather than creating artificial rent extractive effects. The hub has to provide its value on its own merits otherwise it will not succeed.

Transactions fees will not be a key revenue source, we don’t think these will ever be high in Cosmos.

In a multichain world we hope that at least one hop will originate or pass through the $Atom cosmos hub. In order to arbitrage that, Apps on hub can take advantage of the BlockSpace auction market, where they will get guarantees about their ability to have first transactions across contiguous blocks.

(DH) Atom currently number 23 on coin market cap, should it be top 10?

(ZM) believe Atom should be a top 10 asset, if not I will not consider the work I have been doing to have been a success. When executed Atom 2.0 should create a top 10 asset. Lets see what the market makes of it. This is explicitly my goal.

(SA) I am not as focussed on $Atom, but believe Osmosis will be a top 10 asset, we are building a competitor to Binance, which is a top 10 asset

(DH) will Cosmos flip Ethereum?

(ZM) Owns more Eth thank Bitcoin, feels despondent about Bitcoins long term future.

Feels Ethereum is doing a great job, is a better representative of the crypto community, better aligned. Feels rather than flipping Eth, Atom needs to ‘flip all the sh*t between Atom and Eth’

(RSA) Ethereum and Cosmos are both builder communities, veering towards each other. It is hard to be bearish on builders. The success of the recent Cosmos conference speaks volumes.

In 5 years time where is Cosmos?

(ZM) By the time the vision is fulfilled, he expects a seamless user experience, people won’t know what chains they are using. Users are not being exploited, no front running giving cartels profit/

“Digital Markets will be all markets and I am building Digital markets as open source public goods”

Cosmos is an essential part of getting there and Cosmos can help provide economic coordination for the human race.

(SA) Believes in organic Hayekian systems. Wants to rebuild society from the bottom up, with more localised systems, multi-lateral mesh approaches. Mesh networks and a web of trust based systems.

Sees possible improvements beyond PoS – a web of trust based protocol more decentralised than PoS

Keep tearing down systems and replacing them with Organic Mesh ones

(DH) How should a new user explore Cosmos ?

(ZM) Get Keplr wallet @keplrwallet buy $Atom on a central exchange, withdraw to Keplr and use IBC to move to Osmosis, use Osmosis to make a swap for $Stars, IBC Stars token to Stargaze and buy a ‘Bad kids’ NFT on Stargaze

After that, look back at how little gas was used in that whole process, how different does this feel to Ethereum.

Going forward we are trying to reduce the number of clicks this takes. Each clik uses half our users.

Where to find more out more.

Sunny Aggarwal https://twitter.com/sunnya97

Zaki Manian https://twitter.com/zmanian

ATOM 2.0 https://forum.cosmos.network/t/proposal-draft-a-new-vision-for-cosmos-hub/7328

The Inevitability of UNIchain https://medium.com/nascent-xyz/the-inevitability-of-unichain-bc600c92c5c4

END